Mark Twain said: "Prepare for your future since that is where you are going to invest the rest of your life". Asking clever concerns is the only way to get the info you require to begin preparing your future - the rest of your life. and yes that means retirement. Think about the following concerns to ask your financial advisor about retirement preparation.

Women retirement planning is going to be the very same as anybody else. You need to seek help from a monetary planner so that you are prepared and able to retire when the time comes. These organizations will help you determine what you are going to require to have for retirement and how to invest the cash correctly so that you are protected. You will want to think of looking at a retirement planning guide so that you are able to prepare yourself by yourself and have the right knowledge for whatever that you will need to have so that you can retire in comfort.

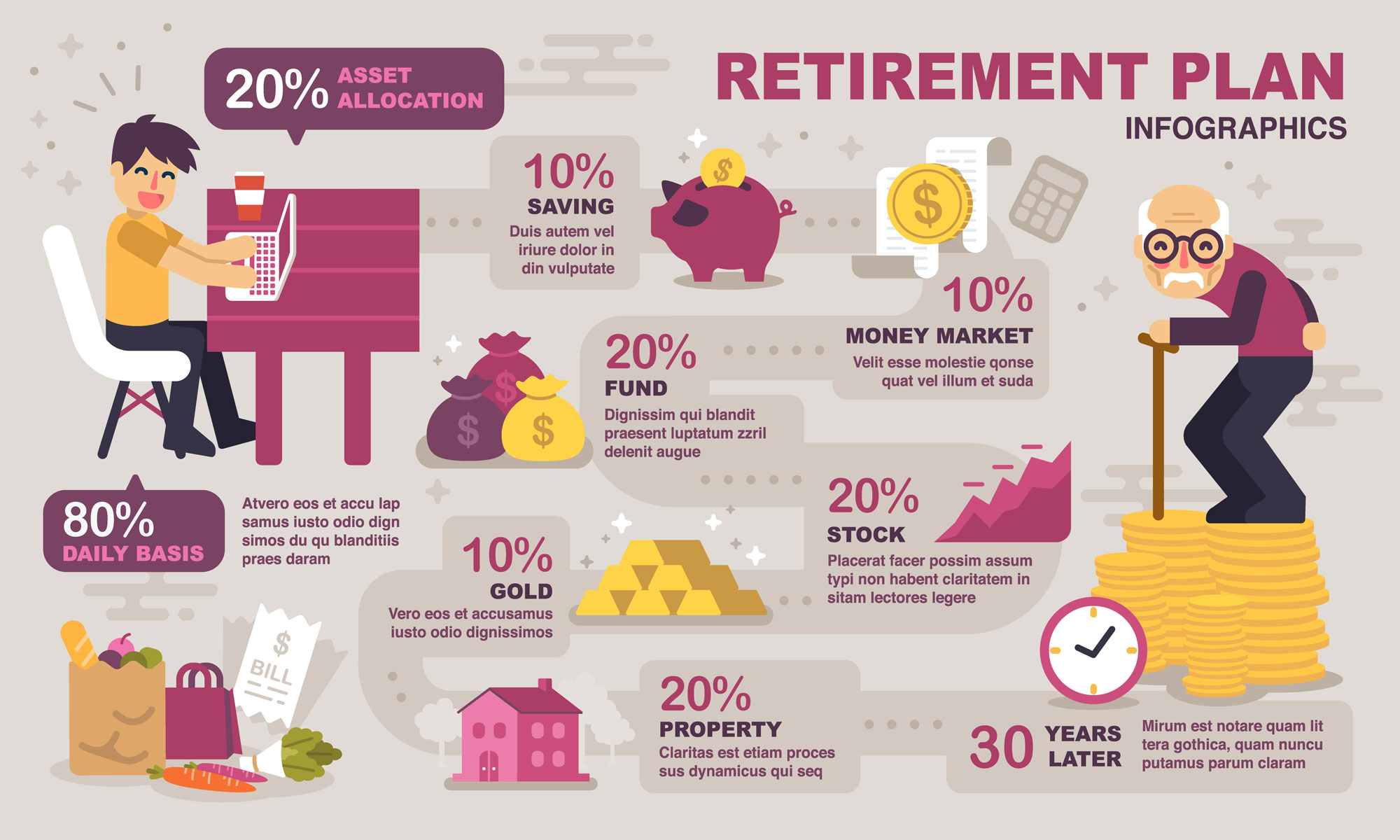

For e.g. Mr. X and Mr. Y both desire to retire at 55 years of age. Mr. X begins investing when he is 25 years of age. So he has thirty years to build his retirement corpus. Even if he invests only Rs.5000 p.m. in equity mutual fund that gives him 15% return p.a. his money can grow to Rs.2.82 cr at the end of 30th year.

Financial preparation is a must to achieve this goal. You need the aid of financial planning software application to make it simple so you do not have to compute it yourself. It is developed to make complete and comprehensive monetary plans of a private over his life span. What is amazing is that it can provide in just minutes.

The first phase in preparation is the examination. This is a total inventory of your exact monetary standing. You must understand how you carry out in terms of financial resources. When you understand your status, setting of goal is the next job. It refers choice retirement business on how you will invest your age by either drown in suffering due to unsettled bills and loans or invest your time circumnavigating the world.

Now you may argue that a person can cut down on his/her costs during retirement life, however this is easier said than done. Think of can you travel by a public transportation once you retire when for whole of your life you have actually travelled in your personal cars and truck. Can you transfer to one BHK home in suburban area when for your whole working life you have stayed in a 3 BHK apartment or condo, at the center of the city? So rather than putting yourself in a situation where you need to cut down on your costs it is much better to plan for your retirement.

It all starts with useful infant boomer retirement planning. Put our experience of the last 18 years to work for you and do your preparing the proper way.

Comments on “Monetary Preparation: Bridging The Gap In Between Today And The Future”